Looking for Does Etoro Have Auto Divident Reinvestment…

Here are our top findings on eToro:

eToro was founded in 2007 and is regulated in 2 tier-1 jurisdictions and one tier-2 jurisdiction, making it a safe broker (low-risk) for trading forex and CFDs.

eToro is exceptional for social copy trading and cryptocurrency trading, and is our top choice for both classifications in 2021. EToro provides an easy to use web platform and mobile app that is fantastic for casual investors, consisting of newbies.

https://www.youtube.com/watch?v=_SEGWJbxToE

For trading forex and CFDs, eToro is a little costlier than most of its rivals, regardless of recently cutting spreads and presenting zero-dollar commissions for United States stock trading. Also, eToro’s range of traditional research materials and tools is limited compared to its peers.

Special Offer:

Trade Forex, CFDs & Commission Free Stocks on a controlled Platform Check Out Website

Score of 91 out of 99. eToro is not publicly traded and does not run a bank. eToro is authorised by two tier-1 regulators (high trust), one tier-2 regulator (average trust), and absolutely no tier-3 regulators (low trust). eToro is authorised by the following tier-1 regulators: Australian Securities & Exchange Commission (ASIC) and the Financial Conduct Authority (FCA). Discover more about Trust Rating.|} eToro uses a total of 2361 tradeable symbols. The following table summarizes the various investment products readily available to eToro clients.

Usability: As a multi-asset broker, eToro goes above and beyond to make the experience smooth for traders. EToro supplies the ability to choose between CFDs versus trading the hidden asset directly from the trade-ticket window. Subtle, however extremely helpful.

Cryptocurrency: Cryptocurrency trading is offered through CFDs and through trading the hidden possession (e.g. purchasing Bitcoin). Note: Crypto CFDs are not offered from any broker’s UK entity, nor to UK homeowners.

| Feature | eToro |

|---|---|

| Forex: Spot Trading | Yes |

| Currency Pairs (Total Forex pairs) | 47 |

| CFDs – Total Offered | 2314 |

| Social Trading / Copy-Trading | Yes |

| Cryptocurrency traded as actual | Yes |

| Cryptocurrency traded as CFD | Yes |

eToro is a market-maker broker and lists a common variable spread of 1 pip on the EUR/USD, which is a little higher than the industry average. When comparing costs alone, retail traders do not choose eToro for its spreads, but rather for its social copy-trading platform capabilities (see Platform and Tools area listed below for more details).

VIP accounts: eToro uses a VIP club membership with 5 tiers varying from silver to diamond for traders who keep balances between $5k -$ 250k. Depending upon the level, advantages differ from a dedicated account manager to marked down withdrawal and deposit charges, access to private signals, and unique possessions, to name a few VIP-style account benefits.

Popular Financier program: eToro’s Popular Investor program has four levels– from cadet to elite– where you can be qualified to receive different benefits. Gain from this program can range from spread out rebates to a month-to-month payment and even a management fee for those who reach elite status. Popular Financier is for traders who allow other investors to copy their strategy.

Is eToro trustworthy?

Cryptocurrency trading: Overall, eToro has rates near to the market average for trading physical cryptocurrency, such as 0.75% for purchasing or offering bitcoin, while its fiat to crypto conversion charge is high at 5%. Converting from crypto to crypto at eToro just costs 0.1% in addition to prevailing spreads. With a a great deal of crypto properties and both CFDs and the underlying, eToro is our top broker for Crypto Trading in 2021.

https://www.youtube.com/watch?v=87VhnbBw-BA

Exchange-Traded Securities: In addition to trading CFD shares, eToro likewise offers zero-dollar commission for US stock trading (not offered to United States investors) and supports fractional shares. For more information, see our UK.StockBrokers.com evaluation of eToro.

I’ve always had an interest in the monetary markets however, like most of us, I had no genuine idea how to break through the castle walls and actually trade. The gatekeepers of Wall St. and The City have permanently been devoted to keeping the masses at bay so they can charge their hefty trading fees (The Wolf of Wall Street — true story).

That all altered about a year back. I was a final year student and encountered a platform called eToro which blew open the doors and permitted me to begin trading online. eToro is up to 20 times more affordable than standard stockbrokers, with 0% commission on real stocks.

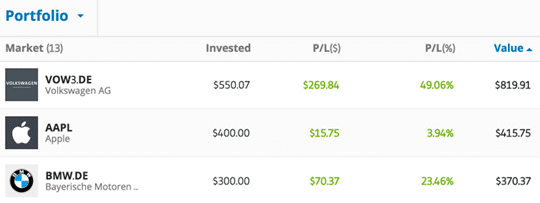

My efficiency over the past year. Previous performance is not an indication of future results. Trading history presented is less than 5 total years and might not be enough as basis for investment choice. This is not investment recommendations.

Sound easy enough? Does Etoro Have Auto Divident Reinvestment

Well, in fact it’s not all that straight-forward. It is necessary for you to understand that I have actually been on rather a finding out curve. Whilst I have actually been taking pleasure in the entire experience, I’ve also made some rookie errors.

For total beginners the eToro platform and the idea of trading itself can be a little intimidating at. With the advantage of hindsight and my own personal trading experience on eToro, I desired to put together a comprehensive no-nonsense guide to help others get the finest outcomes as quickly as possible.

The platform and the larger phenomenon of social investing have actually been commonly covered by mainstream media, including a recent BBC documentary called Traders: Millions by the Minute.

The most distinct function of eToro is probably ‘CopyTrader’. This permits you to sort through other users and clearly see their trading history, consisting of just how much they have actually made or lost over any given duration. If you discover somebody you like the look of, you can allocate some funds to automatically copy their trades.

Another huge plus is the ‘Popular financiers’ program. This rewards users based on the number of copiers they have in the kind of month-to-month commission. The program also incentivises accountable trading, and we’ll discuss this in more depth towards completion of the guide.

With the social and copying functions, you’ll certainly discover a great deal reasonably quickly! Most of the need-to-knows you’ll pick up by reading this guide or playing with a demo account. Does Etoro Have Auto Divident Reinvestment

Relax at the start and make sure you understand what you’re doing prior to investing bigger amounts of money. Trading on eToro can be extremely rewarding but it’s important to keep in mind that, whenever you’re handling the marketplaces, you can lose money too (” your capital is at danger”)!